Help At-Risk Children and Reduce What You Pay the State in Taxes

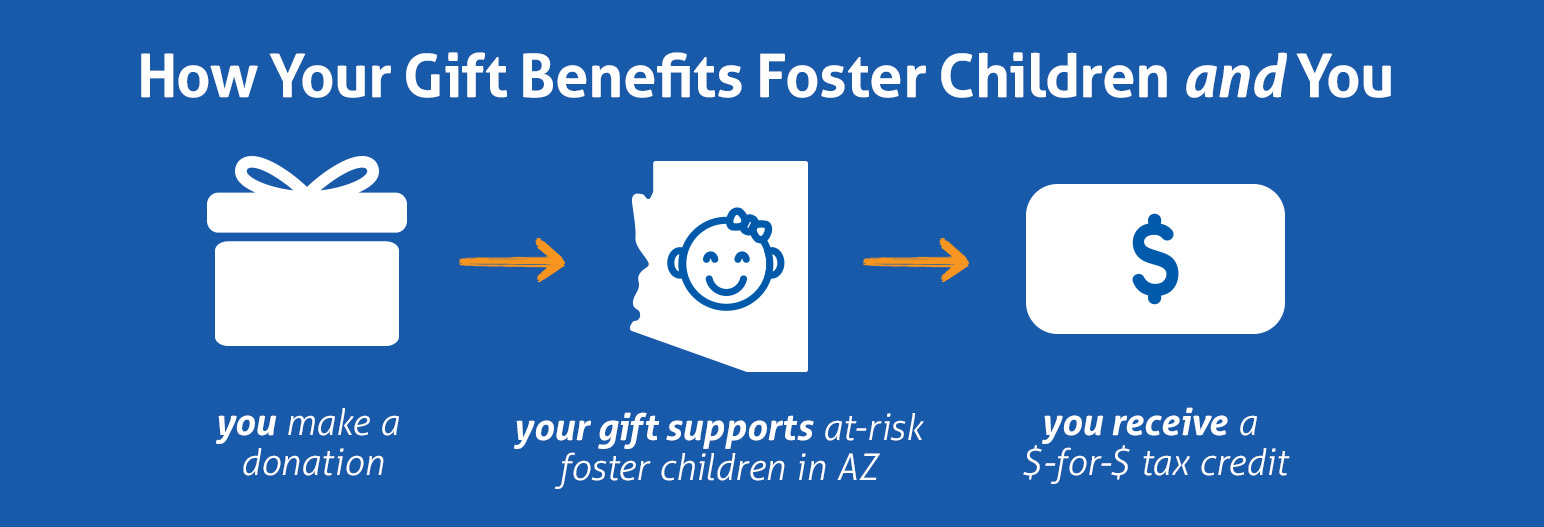

The Arizona Foster Care Tax Credit is a charitable contribution you can give to qualifying 501 (c)(3) organizations that work with over 200 foster children a year.

When you take advantage of the Arizona Foster Care Tax Credit by donating to a qualifying organization like Christian Family Care, you receive a dollar-for-dollar tax credit and reduce what you pay the state in taxes–all while making a difference in the lives of vulnerable youth.

Benefits to the Arizona Foster Care Tax Credit

- Reduce what you pay the state in taxes at no additional cost to you.

- Help Christian Family Care carry out our mission of strengthening families and serving at-risk children in the name of Jesus Christ, rather than paying the state.

- Potentially increase your state tax refund.

- Carry the tax credit forward for up to five years.

Former Governor Doug Ducey on the Arizona Foster Care Tax Credit

Taking Advantage of the Arizona Foster Care Tax Credit

Follow these steps to earn the Arizona Foster Care Tax Credit on your state income taxes:

- Fill out the donation form below to make your donation to Christian Family Care.

- Keep a record of the donation for when you file your taxes.

- Ask your tax advisor to help you claim the dollar-for-dollar credit when you file your Arizona state tax return.

- Place the Christian Family Care Qualifying Foster Care Charitable Organization (QFCO) code on form 352 when filing your Arizona state tax return. Our QFCO code is 10024.

- File your taxes.

Thank you for supporting us as we serve vulnerable children, and congratulations on successfully taking advantage of the Arizona Foster Care Tax Credit!

If you have any issues with the tax credit process please contact us at (602) 234-1935 or TaxCredit@cfcare.org.

Required IRS notice: No goods or services were provided in exchange for this gift.

QFCO Code: 10024

Arizona Foster Care Tax Credit FAQs

What is the Arizona Foster Care Tax Credit?

This is a charitable contribution you can give to qualifying 501(c)(3) organizations that work with over 200 foster children in a year.

With it, you can reduce what you pay the state in taxes by up to:

- $526 (singles) or $1,051 (couples) on your 2023 state tax return;

- $587 (singles) or $1,173 (couples) on your 2024 state tax return.

In other words, you can either pay the state or you can give to serving at risk children through Christian Family Care.

Does this foster care tax credit also apply to federal tax returns?

The Arizona Foster Care Tax Credit is a dollar-for-dollar reduction on your State taxes. Not just a deduction but actual tax credit. Check with your tax professional.

How do I know if I qualify?

The credit is for Arizona taxpayers with income filing as:

- married filing jointly: up to $1,051 for 2023, up to $1,173 for 2024

- single or unmarried head of household: up to $526 for 2023, up to $587 for 2024

- separate returns: up to $526 for 2023, up to $587 for 2024

How do I claim the credit for contributions to a Qualifying Foster Care Charitable Organization?

The credit is available only to individuals/couples filing in Arizona. Christian Family Care’s Qualifying Foster Care Charitable Organization code is 10024. Place this code on form 352 when filing your Arizona tax return in order to take your tax credit.

Can I also take advantage of other State tax credits?

Yes! In addition to the Arizona Foster Care Tax Credit, you may also take advantage of tax credits available through private school tuition tax credit organizations, charitable tax credit (working poor tax credit), and the public school tax credit, further reducing your tax liability. Check with your tax professional.

Do I qualify for the credit if I do not owe taxes at year-end?

The credit reduces your state tax liability independently from any tax that you may have withheld during the year.

If you withheld an amount equal to or greater than your tax liability, the credit will increase your state tax refund. And, you may carry the credit forward for five years.

For more information check out our Ultimate Guide to the Arizona Foster Care Tax Credit.