An Ultimate Guide to the Arizona Foster Care Tax Credit

Listen up Arizona taxpayers!

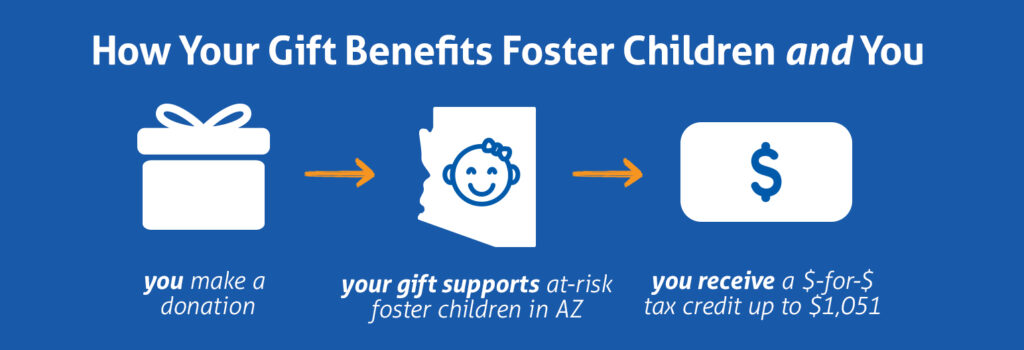

You have the opportunity to receive a tax credit by making a donation to a qualified organization or charity. Dollar-for-dollar, this donation will replace what you would owe the state of Arizona in income taxes up to a certain amount.

Because of these tax credit opportunities, you can make a difference in the lives of children and families most in need in Arizona by simply allocating some of your tax dollars to the places you feel most called to do so.

This also saves our state money when making decisions to allocate other tax payer dollars. Many taxpayers do not take advantage of this easy way to give money towards organizations you are passionate about. There are also ways for you to donate to multiple different charities or organizations by combining different tax credits. There are even ways for you to carry on the tax benefits you receive into following years. We’ll walk you through every step in how to complete your Arizona Foster Care Tax Credit donation in this guide.

Be sure you don’t miss out! You must make your tax credit donations by April 15, 2024, in order for them to apply to the 2023 tax year. Continue reading our “Ultimate Guide to the Arizona Foster Care Tax Credit” to learn more about this and other tax credit opportunities in Arizona. You can also find additional information on the Arizona Department of Revenue state tax credit page. In addition, we encourage you to consult with your tax advisor when filing your personal taxes.

Understanding Arizona Tax Credits

Do you want your tax dollars going to an organization that you are passionate about and feel best serves your community? The state of Arizona gives taxpayers this amazing opportunity thanks to Arizona Tax Credits.

Arizona Tax Credits are continuing to be utilized by taxpayers more and more every tax season. In just a 5 year period, between 2011 and 2016, about $34 million went to qualifying charities in Arizona thanks to the Arizona Tax Credit opportunity.

Why Tax Credits Give the Taxpayer More Control

How does the Arizona Tax Credit give taxpayers in Arizona more control? Arizona Tax Credits allow the taxpayer to choose where a portion of their state income taxes will go. It’s all about having the choice! Let me give you an example of how it works.

Let’s say a married couple filing their taxes jointly, decides to give Christian Family Care, a Qualified Foster Care Organization (QFCO), the maximum $1,051 allowed for a tax credit as a donation around Christmas time. This couple feels passionate about the ministry of Christian Family Care, to serve kids and strengthen families in Arizona. When it’s time for this couple to file their taxes, they have reduced their state tax liability, dollar-for-dollar by $1,051 (the maximum amount a married couple filing jointly can give to a QFCO to receive a tax credit). Their state income taxes have been redirected to help support an organization of their choice, Christian Family Care. If they did not give to any qualified organization and did not receive a tax credit then when it comes time for them to pay their state taxes, the money goes into the general fund instead of going to a qualified organization of your choice. See how your donation to Christian Family Care blesses families and at-risk children here.

What is the difference between a Tax Credit and a Tax Deduction?

It’s very important for you to know the difference between a tax credit and a tax deduction.

A tax credit reduces the amount of money you owe in taxes. For every dollar you give, a dollar you owe the government is subtracted. That’s why we say our tax credit is dollar-for-dollar (up to a certain amount).

Here’s an example that explains a tax credit. Let’s say you make $50,000 in taxable income per year. For the purposes of this example, let’s say the state of Arizona’s tax rate is three percent (please see the IRS website for the current Arizona state income tax rate) You owe the state of Arizona $1,526 in state income taxes at tax season. Now, if you are a single taxpayer and decide to give the maximum amount of $526 to Christian Family Care, that $526 will be subtracted from your Arizona state income taxes that you owe. This is a tax credit. Instead, that $526 help to serve at-risk kids in Arizona while you will only owe the state $974 in state income taxes rather than $1,526 in state income taxes.

A tax deduction is a reduction of income that is able to be taxed.

Here’s an example that demonstrates a tax deduction. Let’s say you donate $526 to a charity that is not a Qualified Charitable Organization (QCO) or a Qualified Foster Care Organization (QFCO). The $526 you donated is considered a tax deduction. If you are an individual making $50,000 in taxable income a year, after giving your tax-deductible gift of $526, your income becomes $49,474 in which you still owe state income taxes on. For the sake of this example, we are saying the Arizona tax rate is three percent. After the tax deduction, this person would now owe $1,484 in state income taxes. Please contact your personal tax advisor for assistance in your personal income tax situation.

Overall, tax credits are more valuable than a tax deduction. A tax credit will help reduce your overall state tax liability and is not impacted by your tax withholdings during the course of the year. If you withheld more than what you owed, the credit will result in an increase in your state tax refund.

If you have no Arizona tax liability for the current year, you may carry the tax credit forward for up to five years. And you don’t have to itemize on your state taxes either—so even working teens can give!

Arizona Tax Credit Opportunities

There are many deserving organizations and charities doing amazing work in Arizona. Reallocating your tax dollars is truly a blessing for these organizations and also blesses your community. Your tax dollars are able to impact areas of your community that you are most passionate about.

Below are some other ways for you to take advantage of other tax credit opportunities in Arizona.

The Arizona Charitable Tax Credit

You may have heard about the “working poor” tax credit. It is now referred to as the Arizona Charitable Tax Credit. For this tax credit opportunity, your donation would need to go to a qualifying charity that helps provide people with temporary assistance in their time of need (TANF) and it also helps low-income families, those who are chronically ill, and people with physical disabilities.

For those taxpayers filing jointly as a married couple you can donate up to $841 and for the individual taxpayer or couples filing separately you can donate up to $421 for a tax credit.

The Arizona Military Family Relief Fund Credit

The Arizona Military Family Relief Fund Credit opportunity helps ease the financial burden of families of service members who are currently deployed and post 9/11 military and veteran families. Assistance for these families is identified by the Arizona Military Family Relief Fund Advisory Committee. You’ll need to give your tax credit donation to this fund by visiting their website here: Arizona Military Family Relief Fund.

This donation must be made before December 31.

This fund can only accept a total of $1 million in donations and if the fund reaches that amount before your donation gets to them, your donation will be returned to you.

For taxpayers filing jointly as a married couple you can donate up to $400 and for the individual taxpayer or couple filing separately you can donate up to $200 for a tax credit.

The Arizona Private School Tax Credit

This Arizona Private School Tax Credit helps provide low to middle-income families an opportunity to send their kids to a private school. This tax credit can also be called, “Credit for Contributions to School Tuition Organizations.” For the year 2022, married couples filing jointly can donate up to $1,245 to the private school of their choice in Arizona. For individuals and married couples filing separately, they can donate up to $623. These donations must be made to certified school tuition organizations. Again, this donation is a non-refundable gift donated to a private school for a tax credit.

The Arizona Form 323 and 348 are what you would need for this tax credit opportunity. Like the other tax credit, this one too can carry forward to the next year up to five years later if it is not used in the tax year it was created.

Overflow/Plus Private School Tax Credit

The overflow/plus private school tax credit is a fairly new tax credit. The way this credit works is a donor must first give the maximum amount toward the private school tax credit. Then, that same donor has the opportunity to give an additional $1,238 if married filing jointly or $620 for single taxpayers. This “overflow” money gets distributed in the form of scholarships to students through participating private schools. The overflow/plus tax credit can be recommended toward a specific student and/or a specific school, which is such a great way to help a student in need!

Taxpayers can donate through April 15, 2024 and count their donations as a tax credit in the preceding tax year of 2023.

The Arizona Public School Tax Credit

The Arizona Public School Tax Credit goes towards public or charter schools. Donations by married couples filing jointly can be up to $400. Donations made by individual taxpayers or married couples filing separately can give up to $200.

These donations will go towards extracurricular activities as well as character education programs at public or charter schools in Arizona. The money can also be used by public schools for books, equipment, school meal programs, student health care supplies and playground equipment.

For more instructions on this tax credit opportunity, you can find them in the Arizona Form 322.

Remember all donations for tax credits are nonrefundable.

The deadline for donations to receive a tax credit is April 15.

Additional Arizona Tax Credits

There are additional tax benefits for businesses and individuals. You can learn more about these additional credits and benefits in Arizona by visiting: The Arizona Department of Revenue tax credits page. You can also find a list of non-refundable tax credits in Arizona here on the AZDor.gov website.

The Arizona Foster Care Tax Credit

Another tax credit opportunity is the Arizona Foster Care Tax Credit. This is a charitable contribution in which you can give money to a qualifying 501(c)(3) organization that works with over 200 foster children in a year. With it, you can reduce what you owe in state taxes by $1,051 (married couples) or $526 (single filers) – all at no additional cost to you. In other words, you can either pay the State or you can give to serving at-risk children through Christian Family Care.

Watch this short video which illustrates how the Arizona Foster Care Tax Credit works!

What is the Arizona Foster Care Tax Credit?

In Arizona, the Foster Care Tax Credit means you can choose a qualifying charity that facilitates foster care and adoption services in our state and make a donation to them. This donation will replace what you would owe the state in income taxes.

For example, married couples can donate up to $1,051 and receive a dollar-for-dollar tax credit. For individuals paying their taxes, they can donate up to $526 to receive a tax credit. Donate to Christian Family Care here!

What is a Qualified Foster Care Organization (QFCO)?

A Qualified Foster Care Organization falls under the umbrella of a Qualifying Charitable Organization (QCO). Qualified Foster Care Organizations must meet certain requirements outlined by the Arizona Department of Revenue (ADOR).

The requirements for an organization to be a certified QCO are to provide immediate basic needs to residents of Arizona who receive temporary assistance for needy families benefits, are low-income residents of Arizona, or are children who have a chronic illness or physical disability. In addition, QCOs must spend at least half of their annual budget on qualified services for qualified Arizona residents. You can read more about this here.

A Qualified Foster Care Organization, like Christian Family Care, must follow the same requirements as a QCO however they must also follow an additional requirement. Qualified Foster Care Organizations must spend at least 50 percent of their budget on services for children placed into foster homes or child welfare agencies. This is outlined in the Arizona Form 352 here.

How to make an Arizona Foster Care Tax Credit donation?

It’s very easy to make a donation to a qualified organization or charity of your choice and receive a tax credit in return. Here are the five simple steps!

Step 1: Find a qualifying charitable organization you wish to donate to.

Step 2: Fill out their form which is usually found on the organization’s website. Christian Family Care’s form is here.

Step 3: Submit your payment through the form. You can also mail a check to the organization.

Step 4: Keep a record of your transaction for your tax records. You can fill out the Arizona Form 352 once you have given to a QFCO.

Step 5: The last step is to subtract your tax credits from how much you owe in Arizona state income taxes. For further questions, please contact your personal tax advisor for assistance in your personal income tax situation.

The guidelines you should be aware of for the Arizona Foster Care Tax Credit

With the Arizona Foster Care Tax Credit there are some guidelines you must know. All donations must be made by individuals. This means you cannot make a donation as a corporation or foundation.

Donations cannot come in the form of goods like toys, clothes, food, services, etc. All donations must be made in cash.

You will not be able to receive a tax credit if you donate to a non-certified charity or organization. This means only donations made to Qualifying Charitable Organizations (QCO) and/or Qualified Foster Care Organizations (QFCO) can be eligible for a tax credit. Learn more about QCOs and QFCOs here.

Some good news is that you can have your tax credit roll onto the next year. For example, if a tax credit from a donation made in 2022 was not used on their 2022 tax return, it can be carried forward to the next year until 2027 if not used before then. Read more about this in our section about restrictions to the Arizona Foster Care Tax Credit.

Don’t miss these important deadlines for the Arizona Foster Care Tax Credit!

We want to make sure that you receive your tax credit once you’ve made a donation to a qualified organization or charity, like Christian Family Care and that is why knowing your deadline is super important.

In Arizona, individual taxpayers (and married couples filing separately) are able to donate up to $526. For married couples filing jointly, they can donate up to $1,051 to a Qualified Foster Care Organization and receive a tax credit through April 15. This means all gifts donated through April 15 will count towards your taxes for the prior tax year.

IRS deadlines for federal tax credits are different than deadlines for state tax credits

The Internal Revenue Service (IRS) has different deadlines for federal taxes than the state of Arizona’s Tax Credit deadline.

According to the IRS, in order for you to see a reduction in your federal taxes, your charitable giving needs to be done before the end of your tax year. You can read more details on this here.

Restrictions to the Arizona Foster Care Tax Credit

You can receive a dollar-for-dollar tax credit from donating to a Qualified Foster Care Organization, however, there is a maximum donation amount.

What is the maximum I can donate to receive a tax credit?

For individuals filing taxes or married couples that file separately, the maximum amount of money you can give to a Qualified Foster Care Organization is $526. For those who are married and filing their taxes jointly, the maximum amount of money you can donate to a QFCO is $1,051.

This doesn’t mean you can only give either $526 or $1,051. You can donate more money than that however these are the maximum amounts in which you will receive a dollar-for-dollar tax credit.

Christian Family Care is a Qualified Foster Care Organization. However, you could also give to a Qualifying Charitable Organization. The maximum amounts to give for a QCO are different than for a QFCO.

For individuals filing taxes or married couples that file separately, the maximum amount of money you can give to a Qualifying Charitable Organization (QCO) is $421. For those who are married and filing their taxes jointly, the maximum amount of money you can donate to a QCO is $841.

What is the minimum I can donate to receive a tax credit?

The good news is that there is no minimum requirement when donating to a Qualified Foster Care Organization (QFCO) or a Qualifying Charitable Organization (QCO). If you would like to donate $2 to Christian Family Care, you can still receive a $2 tax credit which means $2 that you owed in state income taxes would be reallocated to support the work of Christian Family Care or whichever QFCO or QCO you decided to give to.

Tax Credits must be applied within a five year period

Tax credits that are not used can carry forward onto the following year for up to five consecutive years from the year you made that contribution and received your tax credit.

When giving to a QFCO, the form you will need to fill out is called Arizona Form 352 which says you can only carry over the portion of the tax credit that you do not apply to your taxes. Also, you cannot carry over more than the maximum accepted for that one credit.

For example, if you donate $1,500 to Christian Family Care and you file as a married couple filing jointly, you can use the $1,051 as a dollar-for-dollar tax credit.

However, you cannot roll over the additional $526 you gave to Christian Family Care in order to receive another tax credit on your tax return for the following year.

Where to find a list of Qualified Foster Care Charitable Organizations

If you are considering making a tax credit donation please be sure you review the state of Arizona’s list of qualifying charities/organizations here. This list is updated every year. You want to confirm that the organization or charity you are contributing to is certified in order for you to receive an Arizona tax credit.

Christian Family Care is a 501(c)(3) organization that is listed on the Arizona Qualified Foster Care Organizations list. This means we are able to receive donations under the Arizona Foster Care Tax Credit.

Contact Information for the Arizona Foster Care Tax Credit

We truly hope to have answered all of your questions regarding the Arizona Foster Care Tax Credit through this article. However, if you still have questions we recommend you reach out to a personal tax advisor.

Contact the Arizona Department of Revenue

You can also reach out to the Arizona Department of Revenue for any additional questions. If you live in the Phoenix area, the number you would need to call is (602) 255-3381. For those with the area codes of 520 and 928, please call their toll-free number which is (800) 352-4090.

For any general questions about the Arizona Foster Care Tax Credit please call the Arizona Department of Revenue’s customer line at (602) 255-3381. You can also find additional contact information such as address, fax address, individuals to speak with as well as a Live Chat option by going directly to AZDirect.AZ.gov.

Contact Christian Family Care

For any general questions about the Arizona Foster Care Tax Credit please contact us at Christian Family Care: (602) 234-1935 or email us at TaxCredit@cfcare.org

If you would like to learn more about Christian Family Care please feel free to reach out to us at our central Phoenix main office location located at 2346 N. Central Avenue, Phoenix, AZ 85004. You can call our central Phoenix office at (800) 939-5432.

If you are in southern Arizona feel free to connect with our office in Tucson, Arizona located at 3275 West Ina Road, Suite 155 Tucson, Arizona 85741. You can call our southern Arizona office at (520) 296-8255.

If you are in northern Arizona feel free to connect with our office in Prescott, Arizona located at: 106 West Gurley St, Suite 200, Prescott, AZ 86301. You can also call our northern Arizona office at (928) 443-1150.

You can reach us at our mainline. The toll-free number is (800) 939-5432. Please visit our website cfcare.org to learn more about us and the work we are doing as well as our eight different ministries:

- Adoption

- Foster care

- Mentoring

- STRONG Families for Children

- Family, child and marriage counseling

- Pregnancy counseling

- Family Care Learning podcasts, seminars for parents and pastors

- Family Care KIDS Early Childhood Learning Center which is a Christian preschool with trauma informed teachers.

Contact your personal tax advisor

Again, we want to stress that if you have any additional questions related to your taxes and receiving an Arizona Tax Credit please contact your personal tax advisor.

Arizona Foster Care Tax Credit Rundown

We know this is a lot of information on tax credits especially the Arizona Foster Care Tax Credit so we wanted to make a simple list of the top five things you should know about the Arizona Foster Care Tax Credit.

Top Five Things You Need to Know

- The Arizona Foster Care Tax Credit is a charitable contribution you can give to qualifying 501(c)(3) organization that works with over 200 foster children in a year. With it, you can reduce what you owe in state taxes while allocating your tax dollars to a qualified organization or charity that you are passionate about and feel best serves your community. In other words, you can either pay the State or you can give to serving at-risk children through Christian Family Care.

- Giving to a qualifying organization allows you to claim a dollar-for-dollar tax credit up to a certain amount. For the Arizona Foster Care Tax Credit that amount is $1,051 for married couples filing jointly and $526 for individual taxpayers and married couples filing separately.

- Tax credits are more valuable than a tax deduction. Tax credits either reduce what you owe to the state or increase your refund, dollar-for-dollar.

- You may carry the credit forward up to five years.

- The deadline for making a donation to Christian Family Care or another Qualified Foster Care Organization (QFCO) and receiving a tax credit for the year 2023 is April 15, 2024. You must make your tax credit donations by April 15, 2024, in order for them to apply to the 2023 tax year.

Frequently asked questions about the Arizona Foster Care Tax Credit

Does the Arizona Foster Care Tax Credit also apply to federal tax returns?

The Arizona Foster Care Tax Credit is a dollar-for-dollar reduction on your Arizona State income taxes. Not just a deduction but an actual tax credit. For additional information please read above or contact your tax professional.

How do I know if I qualify for an Arizona Tax Credit?

The Arizona Foster Care Tax Credit is for Arizona taxpayers with an income filing as:

‣ married filing jointly: up to $1,051

‣ single or unmarried head of household: up to $526

‣ separate returns: up to $526

How do I claim the tax credit for contributions I have made to a Qualifying Foster Care Organization, like Christian Family Care?

The Arizona Tax Credit is available only to individuals or couples filing in Arizona. Christian Family Care’s Qualifying Foster Care Organization (QFCO) code is 10024. Place this code on the Arizona Form 352 when filing your Arizona tax return in order to take your tax credit.

Can I also take advantage of other State tax credits?

Yes! In addition to the Arizona Foster Care Tax Credit, you may also take advantage of Arizona tax credits available through private school tuition tax credit organizations, charitable tax credit (working poor tax credit), and the public school tax credit, further reducing your tax liability. For additional information please read above or contact your tax professional.

Do I qualify for the Arizona Tax Credit if I do not owe taxes at year-end?

The Arizona Tax Credit reduces your Arizona state tax liability independently from any tax that you may have withheld during the year.

If you withheld an amount equal to or greater than your tax liability, the credit will increase your state tax refund. And, you may carry the credit forward for five consecutive years. For additional information please read above or contact your tax professional.

To receive the Arizona Foster Care Tax Credit, make your gift by clicking the blue button above or, by filling out the form below! We recommend asking your personal tax advisor to help you claim the dollar-for-dollar credit when you file your Arizona state tax return. You may also be able to claim your gift as a charitable deduction on your federal taxes. Christian Family Care’s Qualifying Foster Care Organization code is 10024. Place this code on form 352 when filing your Arizona tax return in order to take your tax credit.

Required IRS notice: No goods or services were provided in exchange for this gift.

QFCO Code: 10024